Build Models That Actually Work

You know that feeling when your spreadsheet breaks for the third time today? When your boss asks "what if we change this assumption" and you have to rebuild everything from scratch?

We've been there. That's why our program focuses on building flexible, resilient models that adapt to real business questions. Not the textbook examples—actual scenarios where executives change their minds halfway through the presentation.

Starting September 2025, we're running our next six-month intensive. It's designed around how financial analysts actually work in the Philippines market, with all its quirks and specific challenges.

Ask About Enrollment

Who's Teaching This

Three analysts who've made every possible mistake so you don't have to. We've worked across banking, corporate finance, and advisory—now we spend our time showing others how to avoid the pitfalls we stumbled through.

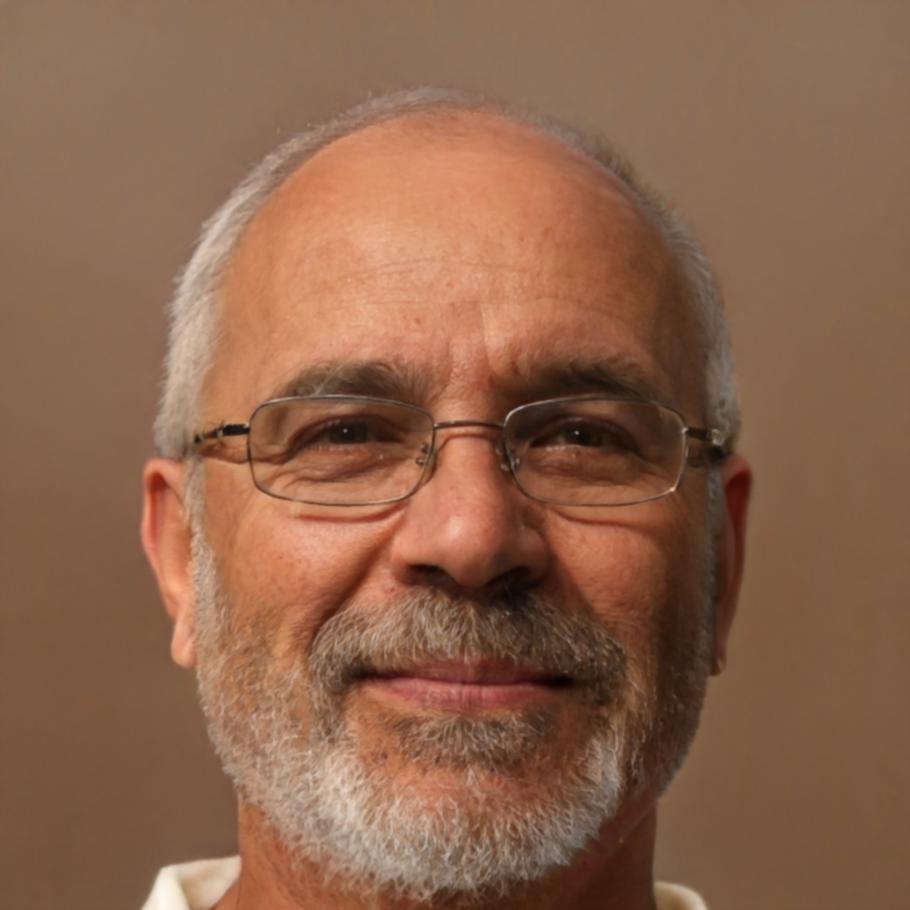

Kristoff Belanger

Corporate Finance Lead

Spent eight years building models for M&A deals. His specialty is making complex valuations understandable—and teaching you how to defend your assumptions when someone inevitably challenges them.

Sienna Radcliffe

Risk Analytics Specialist

Came from banking where she learned the hard way that stress testing isn't optional. She'll show you how to build scenarios that actually help with decision-making instead of just checking boxes.

Verity Ashcroft

Strategic Planning Advisor

Works with companies on long-term financial planning. Her focus is on building models that non-finance people can actually use—because your best model is useless if nobody understands it.

Questions We Get Asked

These come up in every conversation with potential participants. If your question isn't here, just reach out.

What background do I need before starting?

Basic Excel comfort and some exposure to financial statements. You don't need to be a power user—we'll build those skills together. Most participants come from accounting or junior analyst roles and want to level up their modeling capabilities.

How much time should I expect to commit?

About 10-12 hours weekly. That includes live sessions on weekday evenings and weekend practice time. It's structured for people working full-time jobs, so we're realistic about what you can fit in around your schedule.

Will this help me get a promotion or new job?

We can't promise career outcomes—that depends on your situation and opportunities available to you. What we can say is that participants often report feeling more confident in their modeling work and better equipped to handle complex financial analysis.

What happens after the six months end?

You'll have lifetime access to materials and model templates. We also run quarterly alumni sessions where people share challenges they're facing in their current roles. Many participants stay connected and help each other troubleshoot tricky modeling problems.

Is this focused on Philippine business context?

Yes. We use case studies from local companies and address specific challenges in the Philippine market—things like dealing with currency fluctuations, understanding local tax structures, and modeling businesses common in this region.